|

| English: Photo of the Centennial terminal area at the Ninoy Aquino International Airport. (Photo credit: Wikipedia) |

Shortly after signing a multibillion-dollar deal to acquire 50 new planes—the biggest aircraft order in the country’s history—flag carrier Philippine Airlines (PAL) on Thursday disclosed plans to build what could be the largest airport in the Philippines.

The planned airport would be able to handle four times as many flights per hour as the congested Ninoy Aquino International Airport (Naia) in Pasay City. Naia, built in the 1950s, has been criticized as obsolete with decrepit facilities. It can handle 36 flights per hour.

PAL president Ramon S. Ang said investments in infrastructure was part of the company’s aggressive expansion program, which could include rehiring some of the 2,600 employees PAL retrenched in October of last year.

“We have a plan for our own terminal and runway. We still have to clear this with the government but we are hoping they will support us,” Ang told reporters at the sidelines of the firm’s annual shareholders’ meeting.

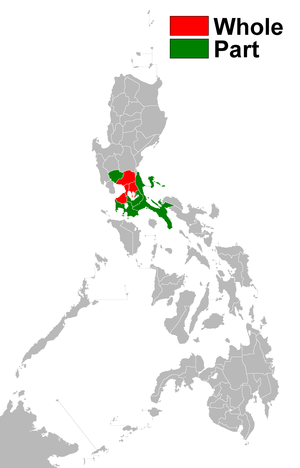

He said the new airport would be closer to Manila than the Clark International Airport in Pampanga, which the government is grooming to replace Naia.

Ang, who also serves as president of PAL’s controlling shareholder San Miguel Corp., declined to disclose the prospective location for the new facility, but said the company would need at least 2,000 hectares of land for the project.

The new airport, which will be exclusive to PAL and sister firm PAL Express (formerly Air Philippines), would have two parallel runways when it opens, with the option of having two more. Parallel runways mean two planes can take off and land at the same time—now impossible at Naia’s perpendicular runways.

Ang said the government’s plan to turn Clark into the country’s premier gateway might be ill-advised, given the facility’s distance from Manila. “If you want to fly [from] Clark, how long will it take you to get to the airport? Two hours if you are coming from Makati. Then you have to wait two more hours for your flight,” Ang said.

He said plans to build a new high-speed railway between Metro Manila and Clark—at an estimated cost of $10 billion—would be too heavy a burden for the government to carry.

Ang said the company would shell out about $500 million in equity for the airport project. The rest of the project cost would be financed using loans from foreign or local banks.

Once approved by the government, he said PAL could complete the project in three years. “We plan to pitch this to President Aquino in January or February. Hopefully, this is aligned with the government’s plans,” he said.